Strike pay dirt.

Happy employees mean a happy employer. The best way to make your employees happy is to pay them well. The next best way is to keep them informed.

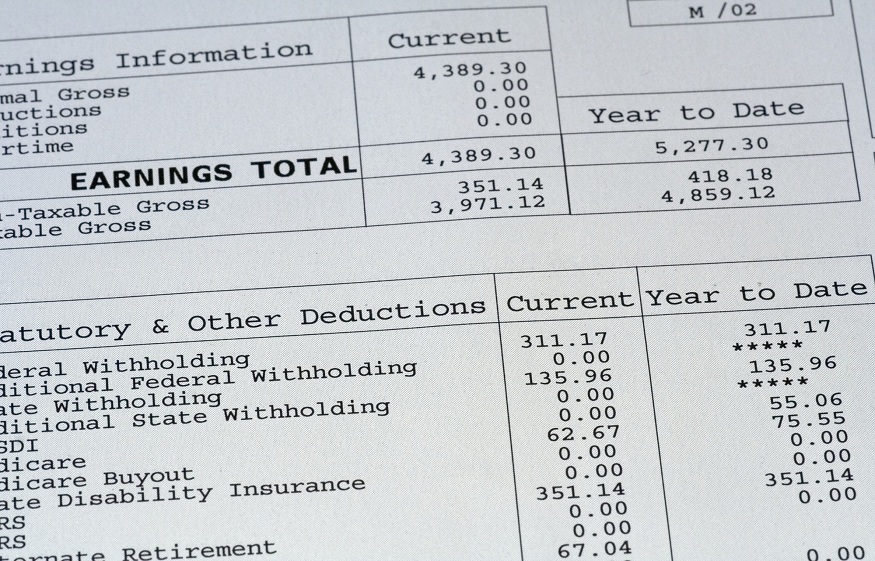

A pay stub is an easy way to break down employee salaries and tax deductions. But many business owners struggle to use them. They are straightforward once you figure out what goes on a pay stub.

Here is a quick guide to the paycheck template.

Follow the Laws

The laws regulating pay stubs vary by state. There is no federal law that regulates pay stubs.

But you must keep accurate records of the hours that your employees work and the wages you pay them. Printing and keeping pay stubs is an easy way of doing that.

Twenty-six states require employers to provide their employees with a pay stub. Print copies of the pay stub for yourself and your employee, and file them so you can access them easily.

The Basic Paycheck Template

There is no law regulating what goes on a pay stub. Since you need records of hours worked and wages paid, you should include that information on your pay stub. You can use a paystub maker or write the stub out by hand.

On a basic template, you should also include the personal information of the employee. Write out their full name, Social Security number, and address. If they are a minor, you should include their birthdate as well.

Include their workweek. Mention the time and day of the week that they start working. Describe the hours they work each day, and include the total hours that they work every week.

Include what your regular hourly pay rate is. Specify if the employee is paid hourly or if they receive a salary. If they worked overtime, detail their overtime compensation.

After this information is listed, describe all deductions from the employee’s wages. Break down each of the taxes they paid, including Medicare, Medicaid, and Social Security. Write what their salary is before and after taxes.

Other Templates

If your employees work hourly, you can choose a pay stub that summarizes their hours. Include a calendar, and write the hours they worked on each day of the week. You can then include their deductions and contact information.

If you hire a contractor, use an invoice instead of a paystub. Include your contact information, then provide a table showing the services they performed and what you paid them.

Specify the nature of your employee’s job if it is relevant. Include a space for a signature, and keep a copy that your employee signs. This shows that they agree with their salary.

Know the Latest Business News

Pay attention to your employees, and they will pay you back with good work. They want to know what their salary is, so show them.

The paycheck template is basic. Include your employee’s contact information, the hours they work, and their pay rate. Break down how you are deducting taxes.

You can get less elaborate if the employee is hourly or a contractor. All you need to show is how long they worked and how you paid them.

Stay in the loop on the latest business news and tips. Check our coverage every day.